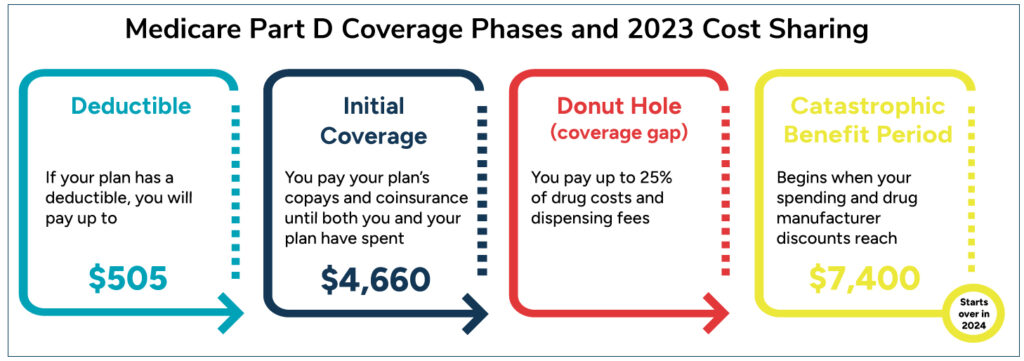

Most Medicare Part D prescription drug plans have a coverage gap, more commonly called a donut hole. You enter the donut hole when your total medication costs—what you and your plan pay—reach a set limit. In 2023, that limit is $4,660.

There are 4 phases to your Medicare drug coverage. Phase 3 is the donut hole. Not everyone will enter the donut hole. One way to avoid the gap is to use generic drugs whenever possible.

What are the Medicare Part D Coverage Phases?

Phase 1: Deductible

You pay the full cost of your prescriptions until you reach your plan’s deductible. Then you move to phase 2. If your plan has a $0 deductible, you begin in phase 2.

In 2023, your deductible cannot be higher than $505. Usually, you will not have to pay a deductible for generic drugs in Tier 1 and Tier 2 of your plan’s formulary. Deductibles typically apply only to brand name drugs in Tiers 3-5.

Phase 2: Initial Coverage

Once you’ve met your deductible, you pay a copayment or coinsurance for each prescription regardless of tier placement until your total drug costs (what both you and your plan pay) reach $4,660. Most people stay in this phase until the end of the year.

Phase 3: Donut Hole

When you are in the donut hole or coverage gap, you will pay 25% of the drug cost and dispensing fee for Tier 3-5 brand medications. Most plans cover generic drugs in this phase the same way they do in the initial coverage phase, meaning copays or coinsurance apply. Some plans require you to pay 25% of both the drug cost and dispensing fee for generic drugs. You get out of the donut hole once your costs and drug manufacturer discounts reach $7,400.

An Example of Brand-Name Drug Costs When You’re in the Donut Hole

| Price of the brand-name drug | $60 |

| Dispensing fee | $2 |

| The drug manufacturer pays (drug cost only) | $60 x .75 = $42 |

|

Your plan pays

|

$3 = $1.50 = $4.50 |

| You pay 25% of the drug cost and dispensing fee | $62 x .25 = $15.50 |

| Amount applied to get you out of the coverage gap | $42 + $15.50 = $57.50 |

Phase 4: Catastrophic Benefit Period

You will pay only a small coinsurance percentage or copayment for covered drugs for the rest of the year.

If You Aren’t Getting a Discount While in the Donut Hole

If you think you’ve entered the donut hole but don’t get a discount when you pay for your brand name prescription, review your next Explanation of Benefits (EOB). If the discount doesn’t appear on the EOB, contact your drug plan to make sure that your prescription records are correct and up-to-date.

If your drug plan doesn’t agree that you’re owed a discount, you can file an appeal.

Help Paying for Medicare Prescription Drugs

There are programs that can help you cover the cost of prescriptions drugs if your income and resources are limited:

- Some drug companies offer programs to help pay for medications for people enrolled in Medicare Part D. Find out whether there’s a Pharmaceutical Assistance Program that can lower prescription costs for the drugs you take.

- Many states and the U.S. Virgin Islands offer help paying for prescriptions, drug plan premiums, and other drug costs. See if your state has a State Pharmaceutical Assistance Program.

- Medicare and Social Security have a program called Extra Help. If you qualify for Extra Help, you could pay no more than:

- $4.15 for each generic covered drug in 2023

- $10.35 for each brand-name covered drug in 2023

Medicare Can Be Confusing. American Exchange Can Help.

There are so many things to consider when choosing Medicare plans, especially if you take medications regularly. Our independent, licensed insurance benefits experts listen to your needs, then find the right plan for you based on your health, medications, and budgetary needs. We also let you know if you qualify for cost-saving programs, like Extra Help for Part D. We do not work for an insurance company, so we compare all plans available in your area at no cost or obligation to you. And you can call us throughout the year if you have questions. Contact us today.

1.888.995.1674 americanexchange.com

Our Medicare experts are available to help you:

Monday through Friday from 8:00 a.m. to 5:00 p.m.

Additional Medicare Resources

We publish a Medicare blog on the 4th Tuesday of every month, and more frequently during Medicare’s Annual Enrollment Period. Be sure to read our Medicare blog posts or flyers to better understand your coverage.

- Medicare Covers Mental Health Services blog

- How the End of the COVID Health Emergencies Affects Your Medicare Coverage

- 3 Questions People Turning 65 Ask about Medicare blog

- Confused by All the Medicare Coverage Options? blog

- Medicare Special Needs Plans Offer Targeted Benefits blog

- Medicare Basics Flyer

- Health Insurance Terms Flyer

Medicare Disclaimer: We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

American Exchange is a licensed health insurance broker. Robert Huffaker, NPN 13568432

Photo courtesy of iStock