An ACA Health Plan May Cost Less than Job-Based Insurance

Health coverage for your family could cost less with an Affordable Care Act (ACA) health plan than through your employer. Now that the IRS has fixed the family glitch, your family may qualify for an ACA plan if your job-based is not considered affordable—if it costs more than 8.39% of your household income. Your family could qualify for financial help through tax credits and subsidies to lower the cost of their ACA plan.

Is my employer plan affordable?

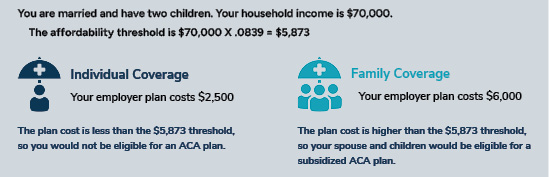

The affordability threshold changes each year. For 2024 health coverage, the affordability threshold is 8.39% of your household income.

To see if your employer plan is affordable for you and your family, multiply your household income by .0839. Healthcare.gov defines household income as the income of the tax filer, their spouse if they have one, and their tax dependents, including those who don’t need coverage.

Then compare that figure to the cost of your job-based coverage. Ask your employer for your 2024 individual and family premium costs.

Here’s an example:

⊕ Download our Family Glitch Explained flyer to keep this example handy.

If your job-based coverage costs less than 8.39% of your household income for you alone, you would not qualify to enroll in an ACA plan. But if the health plan is not affordable when you add your spouse and children, they would be eligible for an ACA marketplace plan, and may even qualify for tax credits to reduce the plan costs.

What tax credits is my family eligible for?

Tax credits are based on the total number of people in your household and your household income. Your household income must be at least 100% of the federal poverty line. In 2024:

- An individual must earn at least $14,580

- A family of 4 must earn at least $30,000

⊕ Click here for the FPL for 2024 plan coverage.

Don’t pay more for healthcare coverage than you need to

Healthcare premiums rose 7% in 2023, costing an average of $6,575 for family premiums. If you work for a company with less than 200 employees, you pay nearly $2,500 more toward family premiums than those at larger firms. Costs are expected to increase again this year.

It’s worth checking to see if you could lower your healthcare costs by enrolling your family in an ACA plan. But you need to act quickly.

- You won’t be able to enroll your family in your employer’s plan after your company’s open enrollment period ends.

- ACA Open Enrollment runs from November 1, 2023 – January 15, 2024.

- For coverage to begin on January 1, 2024, you have to enroll by December 15, 2023.

American Exchange can help you enroll in an ACA plan

American Exchange’s benefit experts can help you find a plan that meets your family’s needs and make sure they get all the tax credits they are eligible for. There is no cost to get enrollment help from American Exchange. Contact us today.

Call: 1.888.995.1674 Email: enroll@americanexchange.com

Visit Our ACA Insurance Webpage

Extended Hours During Open Enrollment (November 1, 2023 – January 15, 2024)

Monday – Friday from 8:00 a.m. – 8:00 p.m. Eastern

Saturday from 8:00 a.m. – 8:00 p.m. Eastern

We are closed the following holidays:

- Thanksgiving: November 24-25

- Christmas: December 23-25

- New Year’s Day: January 1

ACA Health Plan Resources

We publish a blog covering important ACA marketplace topics the second Tuesday of each month, and more often during Open Enrollment, which begins November 1st each year. We also create handouts to address common topics impacting ACA enrollees. Click on the link below to read or download:

- Prepare Now for 2024 ACA Open Enrollment blog

- Beware of Limited Benefit Plans blog

- Reporting Income and Household Changes to the ACA Marketplace blog

- Your Family Could Qualify for ACA Health Plan Subsidies Even if You’re Working blog

- Subsidies Help Lower Your ACA Health Plan Costs blog

- Do You Qualify for an ACA Special Enrollment Period? blog

- Health Insurance for Your College Student blog

- Health Insurance Terms pdf

- Understanding ACA Metal Plans pdf

American Exchange is a licensed health insurance broker. Robert Huffaker, NPN 13568432

Photo courtesy of iStock