Special Enrollment Period (SEP)

Do I Qualify for an ACA Special Enrollment Period (SEP)?

Life has ups and downs. When a life changing event impacts your health insurance, you may qualify for an Affordable Care Act special enrollment period (SEP). An SEP is a short window outside of open enrollment when you can enroll in an ACA health plan due to a life event. Your new coverage usually starts the first of the month after you enroll.

Qualified Life Changing Events

The number of people in your household changed

You may qualify for a SEP if you or anyone in your household, in the last 60 days:

- You got married.

- You had a baby, adopted a child, or placed a child for foster care.

- You got divorced or legally separated and lost health insurance. Divorce or legal separation without losing coverage doesn’t qualify you for a Special Enrollment Period.

- Someone on your ACA health plan died and you are no longer eligible for your current health plan.

You’re moving

You may qualify for a SEP if you or anyone in your household, in the last 60 days:

- You’re moving to a new home in a new ZIP code or county

- You’re moving to the U.S. from a foreign country or United States territory

- You’re a student moving to or from the place you attend school

- You’re a seasonal worker moving to or from the place you both live and work

- Your’e moving to or from a shelter or other transitional housing

To be eligible for a SEP, you must prove you had qualifying health coverage for one (1) or more days during the 60 days before your move. You don’t need to provide proof if you’re moving from a foreign country or US territory. Moving only for medical treatment or staying somewhere for vacation doesn’t qualify you for a SEP.

You lost your health insurance

You may qualify for a SEP if you or anyone in your household lost qualifying health coverage in the past 60 days or expects to lose coverage in the next 60 days. Circumstances include:

- Losing job-based health coverage through your or a family member’s employer, including if you are covered through a parent or guardian because you’re no longer a dependent

- Voluntarily dropping coverage you have as a dependent doesn’t qualify you for a SEP unless you also had a decrease in household income or a change in your previous coverage that made you eligible for savings on an ACA plan

- Losing individual health coverage, including if:

- Your individual plan or ACA plan is discontinued

- You are no longer eligible for a student health plan

- You no longer live in the plan’s service area

- Your individual or group health plan coverage year is ending in the middle of the calendar year and you choose not to renew it

- Your household income decreased, and now you qualify for savings on an ACA plan

- Losing coverage through a family member, including if:

- You turn 26 (or the maximum dependent age allowed in your state) and can no longer be on a parent’s plan

- A family member loses health coverage for their dependents

- A divorce or legal separation

- The death of a family member

- You’re no longer a dependent

- Losing premium-free Medicare Part A coverage:

- You don’t qualify for a SEP if you lose Medicare Part A because you didn’t pay your Medicare premium or lose Medicare Parts B or D only

- Losing or were denied Medicaid or Children’s Health Insurance Program (CHIP) coverage because:

- You are no longer eligible

- Your child ages off CHIP

- You applied for Medicaid/CHIP or ACA coverage during Open Enrollment or with a different SEP and were told you might be eligible for Medicaid/CHIP. But when your state agency told you that you weren’t Medicare or CHIP eligible, ACA Open Enrollment or your Special Enrollment Period had ended.If you have been told or think you may lose coverage during the Medicaid unwinding currently taking place, read our blog, Act Now if You Have Medicaid, CHIP, or BHP Coverage, to see what you need to do.

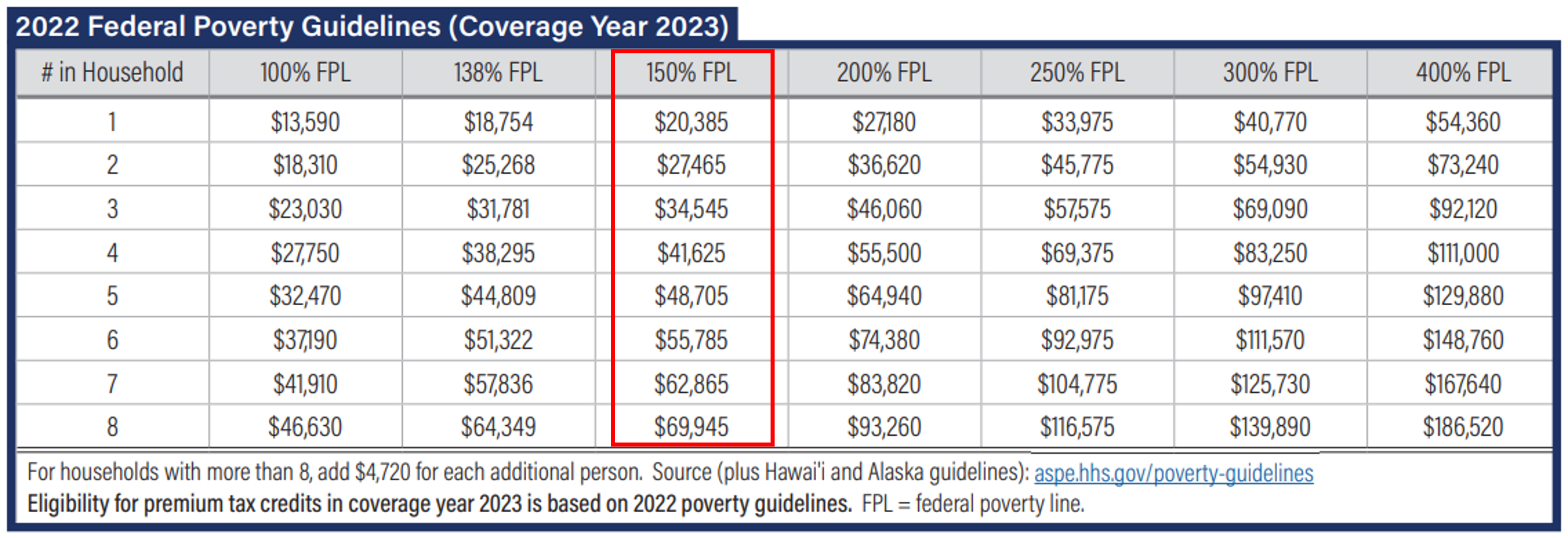

Your Income is below 150% of the Federal Poverty Line (FPL)

If your household income is below 150% of the federal poverty level (FPL), you are eligible to enroll in an ACA health plan any time during the year. This is considered a life changing event that qualifies you for a special enrollment period (SEP). You may even qualify for a $0 premium ACA health plan.

The following table shows the FPL for 2023 marketplace coverage based on the number of people in your household. If at any time during the year your income dips below 150% for your entire household, you qualify for a special enrollment period.

Table. Federal Poverty Level Chart for the 2023 ACA Coverage Year

An employer offers to help with the cost of coverage

You may qualify for a SEP if you or anyone in your household were offered an individual coverage HRA or a Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) in the past 60 days or expects to in the next 60 days. Your employer may refer to an individual coverage HRA by a different name like “ICHRA.”

Please note that you cannot enroll online in this situation. You will need to have an independent insurance agent (like American Exchange), navigator, or the Marketplace assist you.

Other qualifying life circumstances

- You are now or soon will be a member of a federally recognized tribe or will get status as an Alaska Native Claims Settlement Act (ANCSA) Corporation shareholder

- You became a U.S. citizen

- You were or soon will be leaving incarceration

- You are starting or ending service as an AmeriCorps State and National, VISTA, or NCCC member

If you aren't sure if you qualify for a SEP, we can help you figure it out. Please Call: 888.995.1674

Do I Qualify for Medicare Special Enrollment Period (SEP)?

Because life changes, you can make changes to Medicare Advantage and Medicare Part D (prescription drug) coverage, like if you move or you lose other insurance coverage. These chances to make changes are called Special Enrollment Periods (SEPs). Rules about when you can make changes and the type of changes you can make are different for each SEP.

Qualified Life Changing Events

You Moved

You moved outside of your plan’s service area

- You can switch to a new Medicare Advantage Plan or Medicare Prescription Drug Plan.

- If you tell your plan before you move, your chance to switch plans begins the month before the month you move and continues for 2 full months after you move.

- If you tell your plan after you move, your chance to switch plans begins the month you tell your plan, plus 2 more full months.

You moved to a new address that’s still in your plan area, but you have new plan options in that new location.

- You can switch to a new Medicare Advantage Plan or Medicare Prescription Drug Plan.

- If you tell your plan before you move, your chance to switch plans begins the month before the month you move and continues for 2 full months after you move.

- If you tell your plan after you move, your chance to switch plans begins the month you tell your plan, plus 2 more full months.

You moved back to the US after living outside the country.

- Join a Medicare Advantage Plan or Medicare Prescription Drug Plan.

- Your chance to join lasts for 2 full months after the month you move back to the U.S.

You moved into, currently live in, or just moved out of an institution, like a skilled nursing facility or long-term care hospital. Your chance to join, switch, or drop coverage lasts as long as you live in the institution and for 2 full months after the month you leave the institution.

- Join a Medicare Advantage Plan or Medicare Prescription Drug Plan.

- Switch from your current plan to another Medicare Advantage Plan or Medicare Prescription Drug Plan.

- Drop your Medicare Advantage Plan and return to Original Medicare.

- Drop your Medicare prescription drug coverage.

You were released from jail and you kept paying for your Part A and Part B coverage while you were in jail, you have 2 full calendar months after you’re released from jail to join a plan. You have to sign up for Medicare before you can join a plan.

-

- Join a Medicare Advantage Plan or Medicare Prescription Drug Plan.

You Lost Your Current Coverage

You are no longer eligible for Medicaid. You have 3 full months from either the date you’re no longer eligible or notified, whichever is later to:

- Join a Medicare Advantage Plan or Medicare Prescription Drug Plan.

- Switch from your current plan to another Medicare Advantage Plan or Medicare Prescription Drug Plan.

- Drop your Medicare Advantage Plan and return to Original Medicare.

- Drop your Medicare prescription drug coverage.

You left coverage from your employer or union, including COBRA coverage.

- Join a Medicare Advantage Plan or Medicare Prescription Drug Plan.

- Your chance to join lasts for 2 full months after the month your coverage ends.

You involuntarily lost other drug coverage that’s as good as Medicare drug coverage (creditable coverage), or your other coverage changed and is no longer creditable.

- Join a Medicare Advantage Plan or Medicare Prescription Drug Plan.

- Your chance to join lasts 2 full months after the month you lose your creditable coverage or you’re notified that your current coverage is no longer creditable, whichever is later.

You had drug coverage through a Medicare Cost Plan and you left that plan.

- Join a Medicare Advantage Plan or Medicare Prescription Drug Plan.

- Your chance to join lasts 2 full months after the month you lose your creditable coverage or you’re notified that your current coverage is no longer creditable, whichever is later.

You dropped your coverage in a Program of All-Inclusive Care for the Elderly (PACE) plan.

- Join a Medicare Advantage Plan or Medicare Prescription Drug Plan.

- Your chance to join lasts for 2 full months after the month you drop your Program Of All-Inclusive Care For The Elderly (Pace) plan.

Your Plan Changes its Contract with Medicare

Medicare takes an official action, called a sanction, because of a problem with the plan that affects you.

- Switch from your Medicare Advantage Plan or Medicare Prescription Drug Plan to another plan.

- Your chance to switch is determined by Medicare on a case-by-case basis.

Medicare ends your plan’s contract.

- Switch from your Medicare Advantage Plan or Medicare Prescription Drug Plan to another plan.

- Your chance to switch starts 2 months before and ends 1 full month after the contract ends.

Your Medicare Advantage Plan, Medicare Part D Plan, or Medicare Cost Plan’s contract with Medicare isn’t renewed.

- Switch from your Medicare Advantage Plan or Medicare Prescription Drug Plan to another plan.

- You can make changes between December 8–the last day in February.

Other Special Circumstances

You are eligible for both Medicare and Medicaid.

- Join, switch, or drop your Medicare Advantage Plan or Medicare prescription drug coverage during each of these periods:

- January – March

- April – June

- July – September

You qualify for Extra Help paying for Medicare prescription drug coverage.

- Join, switch, or drop your Medicare Advantage Plan or Medicare prescription drug coverage during each of these periods:

- January – March

- April – June

- July – September

You are enrolled in a State Pharmaceutical Assistance Program (SPAP) or lose SPAP eligibility.

- Join either a Medicare drug plan or a Medicare Advantage Plan with prescription drug coverage.

You dropped a Medigap policy the first time you joined a Medicare Advantage Plan.

- Drop your Medicare Advantage Plan and enroll in Original Medicare. You’ll have special rights to buy a Medigap Policy.

You have a severe or disabling condition, and there’s a Medicare Chronic Care Special Needs Plan (SNP) available that serves people with your condition.

- Join a Medicare Chronic Care Special Needs Plan (SNP).

You are enrolled in a Special Needs Plan (SNP) and no longer have a condition that qualifies as a special need provided by the plan.

- Switch from a Special Needs Plan (SNP) to a Medicare Advantage Plan or Medicare Prescription Drug Plan starting from the time you lose your special needs status, up to 3 months after your SNP’s grace period ends.

You joined a plan or chose not to join a plan due to an error by a federal employee.

- Your chance to change coverage lasts for 2 full months after the month you get a notice of the error from Medicare. You can:

- Join a Medicare Advantage Plan with drug coverage or a Medicare Prescription Drug Plan.

- Switch from your current plan to another Medicare Advantage Plan with drug coverage or a Medicare Prescription Drug Plan.

- Drop your Medicare Advantage Plan with drug coverage and return to Original Medicare.

- Drop your Medicare prescription drug coverage.

You weren’t properly told that your other private drug coverage wasn’t as good as Medicare drug coverage (creditable coverage).

- Join a Medicare Advantage Plan with drug coverage or a Medicare Prescription Drug Plan.

- Your chance to join lasts for 2 full months after the month you get a notice of the error from Medicare or your plan.

Let our Medicare experts see if you qualify for a Medicare Special Enrollment Period.

Contact Us

Use the form below to contact an American Exchange team member.

CALL:

888.995.1674

FAX:

423-567-1075

EMAIL:

info@americanexchange.com

ADDRESS:

605 Chestnut Street

Suite 1210

Chattanooga, TN 37450

Get Directions